Mr. XRP Goes to Washington: Ripple CEO Brad Garlinghouse Delivers a Wake-Up Call to Capitol Hill

Crypto isn’t the enemy. Broken regulation is. And this week, D.C. may have finally gotten the message.

Brad Garlinghouse, CEO of Ripple, made headlines after testifying before the U.S. Senate Banking Committee. But he wasn’t just there to talk XRP. He was there to speak for 52 million Americans who hold crypto.

And this time, Washington might have actually listened.

What Ripple’s CEO Told Congress: Crypto Deserves Clarity, Not Chaos

Standing tall in front of the Senate, Garlinghouse didn’t mince words. He laid out the urgent need for clear and fair crypto regulation, highlighting how current SEC overreach is damaging U.S. competitiveness and driving innovation abroad.

Key Points from His Testimony

• Crypto holders aren’t fringe. They’re nearly 1 in 5 American adults

• The SEC’s enforcement-first strategy is a war of attrition on innovation

• Lack of clarity is forcing startups and capital offshore

• Congress must act now, starting with bills like the Lummis-Gillibrand Responsible Financial Innovation Act

Garlinghouse called on lawmakers to protect both consumers and entrepreneurs. He made it clear that Ripple isn’t just defending itself. It’s fighting for the future of U.S. crypto leadership.

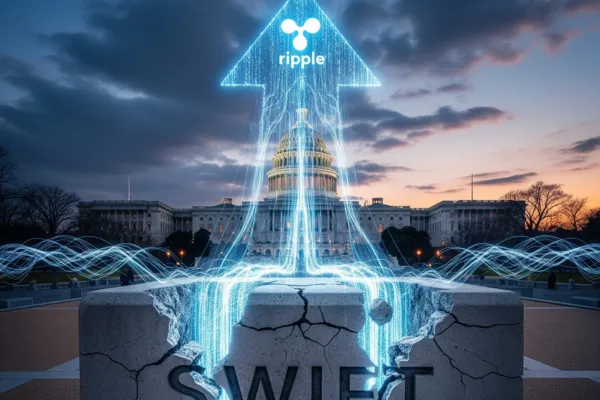

A Game-Changer for XRP: Ripple Unveils Its Global Payment Network

As if one power move wasn’t enough, Ripple also announced the launch of a next-generation blockchain payment platform designed to replace SWIFT, the outdated system that powers international banking.

Why It Matters

• SWIFT processes more than $5 trillion a day but is slow, expensive, and outdated

• Ripple’s platform will use XRP as the bridge currency for real-time and low-cost cross-border settlements

• Partnerships are already underway with central banks and top-tier financial institutions

• This isn’t hype. It’s a functioning alternative with global implications

If Ripple succeeds, XRP shifts from speculative asset to foundational financial infrastructure.

What This Means for Long-Term Crypto Investors

For years, XRP was seen as full of promise but lacking delivery. That perception is starting to shift.

This week brought two major validations:

• Regulatory engagement at the highest levels

• A concrete product solving real-world problems

For yield-focused investors and crypto-savvy professionals, this could mark the beginning of a second wave for XRP:

• Institutional credibility

• Use-case maturity

• Global utility

This isn’t about XRP to $10 hype. It’s about Ripple possibly becoming the backbone of international finance.

The Bottom Line: Real Utility, Real Momentum

We always say it. Buy, hold, and earn yield. While XRP hasn’t always delivered in the yield department, that could change as adoption grows and DeFi platforms start incorporating the asset.

More importantly, Ripple just gave us a powerful reminder:

Regulatory clarity and real-world utility equals long-term value.

Crypto is maturing. The grown-ups are showing up to the table. And XRP is no longer a sleeper play.

Watch This Space

Ripple’s not just fighting back. They’re building forward.

And that’s exactly the kind of energy we like to see.